The financial world is changing very fast. Today, many real world assets are being converted into digital tokens through blockchain technology. This process is called tokenization. As this system grows, one important topic is becoming more popular, and that is rwa tokenization audit.

If you are new to this field, do not worry. This guide will explain everything in simple English. Even a school student can understand how rwa tokenization audit works, why it is important, and how it protects investors.

Let us start from the beginning.

What Is RWA Tokenization?

RWA stands for Real World Assets. These are physical or traditional assets such as property, gold, bonds, invoices, or other valuable items.

Tokenization means converting these assets into digital tokens on a blockchain. Each token represents a small part of the asset. For example, instead of buying an entire building, a person can buy a small digital share of it.

This makes investing easier and more accessible.

However, whenever money and assets are involved, there must be proper checking and verification. This is where rwa tokenization audit becomes important.

What Is an RWA Tokenization Audit?

An rwa tokenization audit is a detailed review process. It checks whether a tokenized real world asset is legal, secure, accurate, and properly managed.

In simple words, it is like a full inspection. Just like a school checks exam papers for mistakes, an audit checks digital assets to make sure everything is correct and safe.

The audit ensures:

- The real world asset truly exists

- The asset is legally owned

- The token represents the correct value

- The smart contracts are secure

- All rules and regulations are followed

Without a proper rwa tokenization audit, investors may face risks such as fraud, errors, or legal problems.

Why Is RWA Tokenization Audit Important?

A rwa tokenization audit plays a very important role in building trust. When people invest their money, they want to feel safe. They want to know that their investment is real and protected.

Here are some main reasons why rwa tokenization audit is important:

1. Prevents Fraud

Fraud can happen if someone claims to tokenize an asset that does not exist. An audit checks documents and ownership records to confirm the asset is real.

2. Protects Investors

Investors need protection. An audit verifies that tokens correctly represent ownership shares and that no false information is provided.

3. Ensures Legal Compliance

Every country has financial laws. A rwa tokenization audit checks whether the project follows all legal requirements.

4. Improves Transparency

Transparency means openness and clarity. An audit creates a clear record of how the asset is managed and tokenized.

5. Builds Market Confidence

When projects are audited properly, more people feel confident about investing.

Key Steps in an RWA Tokenization Audit

Now let us understand how a rwa tokenization audit is conducted. The process includes several important steps.

Step 1: Asset Verification

The first step is to confirm that the real world asset truly exists. Auditors check documents such as:

- Ownership papers

- Legal registrations

- Valuation reports

They confirm that the asset is real and legally owned by the issuer.

Step 2: Legal Review

After verifying the asset, auditors review legal compliance. They check whether the tokenization process follows financial laws and regulations.

This includes reviewing contracts and ensuring proper disclosures are made to investors.

Step 3: Smart Contract Audit

Smart contracts are digital programs that automatically manage token transactions.

A rwa tokenization audit carefully examines these smart contracts to ensure:

- No coding errors

- No security weaknesses

- No hidden risks

If smart contracts have mistakes, hackers could exploit them. So this step is very important.

Step 4: Token Structure Review

Auditors examine how tokens are structured. They check:

- Total supply of tokens

- Ownership rights

- Voting rights, if any

- Profit distribution rules

Everything must match the real world asset details.

Step 5: Financial Transparency Check

This step ensures that financial data is accurate. If the asset generates income, auditors check:

- Revenue reports

- Expense records

- Profit calculations

Clear financial records increase trust.

Step 6: Risk Assessment

Every investment has risks. A rwa tokenization audit identifies potential risks such as:

- Market risk

- Legal risk

- Technology risk

- Operational risk

After identifying risks, solutions are suggested to reduce them.

Types of RWA Tokenization Audits

There are different types of rwa tokenization audit processes depending on the focus area.

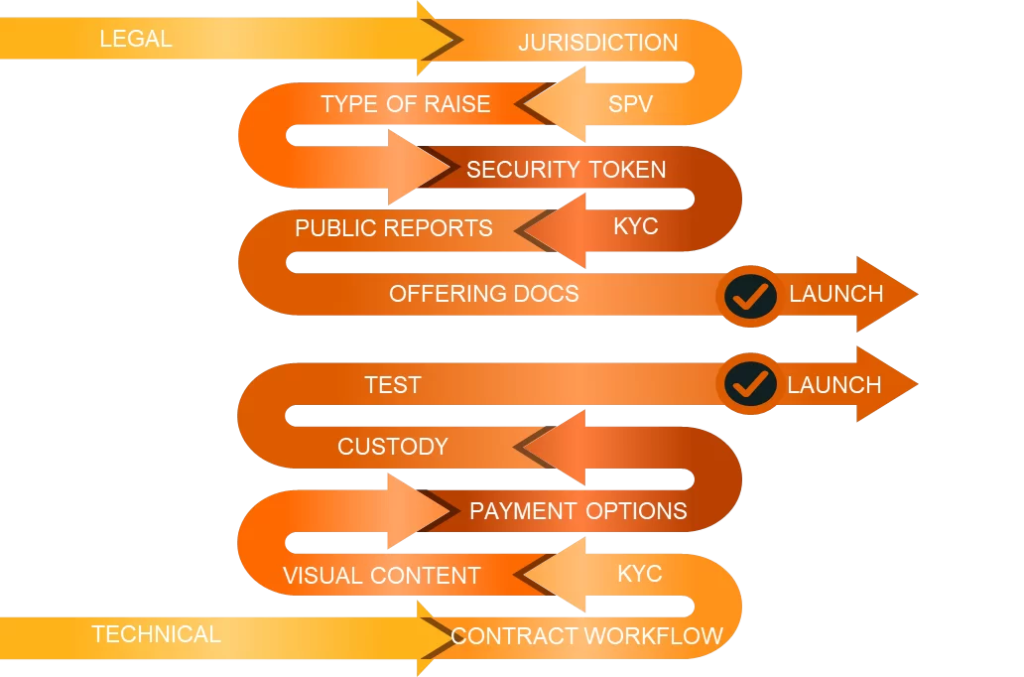

Technical Audit

This focuses on blockchain technology and smart contracts. It checks security and coding quality.

Legal Audit

This ensures that the tokenization process follows legal requirements.

Financial Audit

This verifies financial records and asset valuation.

Compliance Audit

This ensures the project follows regulatory standards and reporting rules.

Each type plays an important role in protecting the ecosystem.

Common Challenges in RWA Tokenization Audit

While rwa tokenization audit is important, it is not always easy. There are some challenges.

Complex Regulations

Different countries have different laws. It can be difficult to follow all rules, especially for global projects.

Technology Risks

Blockchain technology is advanced. Not all auditors have deep technical knowledge.

Asset Valuation Issues

Determining the correct value of real world assets can sometimes be complicated.

Data Accuracy

If incorrect data is provided at the beginning, the audit results may also be affected.

Despite these challenges, audits remain necessary for safety and transparency.

Benefits of RWA Tokenization Audit for Beginners

If you are new to investing, understanding rwa tokenization audit can protect you from mistakes.

Here are some benefits:

- You learn how to identify safe projects

- You understand how digital assets are verified

- You reduce the chance of investing in risky schemes

- You gain confidence in blockchain based investments

Knowledge is power. When you understand audits, you make smarter decisions.

The Future of RWA Tokenization Audit

As tokenization grows, rwa tokenization audit will become even more important.

In the future:

- Regulations may become clearer

- Audit standards may become more advanced

- Technology tools may improve verification speed

- Investor awareness may increase

The financial world is moving toward digital systems. Proper audits will support this transition and ensure safety.

Simple Example to Understand RWA Tokenization Audit

Let us imagine a simple example.

Suppose a company tokenizes a building worth one million dollars. They create one thousand digital tokens. Each token represents a small share of the building.

Before selling these tokens, a rwa tokenization audit checks:

- Does the company truly own the building?

- Is the building value correct?

- Are the tokens structured properly?

- Is the smart contract secure?

- Are all legal rules followed?

If everything is correct, investors can feel safer buying the tokens.

Without an audit, there could be hidden problems.

Conclusion

The Complete Guide to RWA Tokenization Audit for Beginners shows that auditing is not just a technical process. It is a protection system.